We evaluate the truths behind 4 common property sayings

The Singapore property market is awash with sayings and platitudes. Some old favourites include “If you want to see a more expensive house, come back to view this one tomorrow,” or “Selling this will be easy, people who stay on the east side will always buy on the east side”.

The tricky thing is, a lot of these sayings are hard to verify. As with so many things in life (and real estate), the truth is somewhere in between. So in this week’s article, we’re going to take the most common sayings about private property in Singapore, and see how well they hold up to scrutiny:

(If you feel there are any we’ve missed out, please let us know on Facebook. We’ll see if we can dig deeper into them!)

We actually had a detailed explanation of this in a previous article; but let’s take a look at the current situation today.

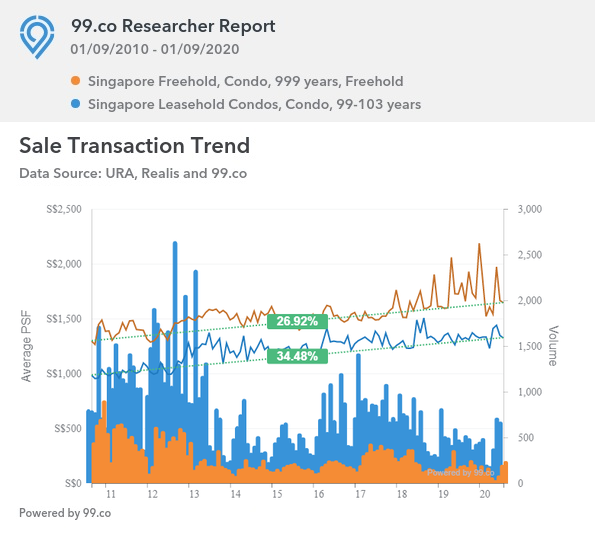

First, we took a quick snapshot of the past decade. We compared the price appreciation of leasehold properties between Sept 1, 2010, to Sept 1, 2020.

(We have excluded all Executive Condominiums; for freehold, we included 999-year lease properties, as they are effectively similar)

Over the past 10 years, freehold properties have appreciated from $1,296 to $1,644, or about 26.9 per cent. This is an annualised gain of about 2.41 per cent.

Leasehold properties, over the same period, have appreciated from $984 psf, to $1,323 psf, or about 34.48 per cent. This is an annualised gain of 3 per cent.

So is it safe here to conclude that leasehold properties have better appreciation? Not quite.

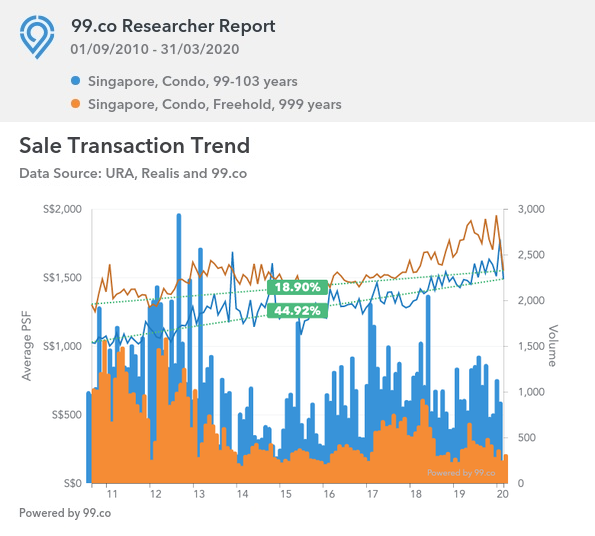

Look what happens when we change the end date to March 31, 2020 instead, the gap between freehold and leasehold becomes much more substantial here.

Going on that train of thought, there could also be cases where the narrative is flipped – and it may seem that freehold properties do perform better instead. This can easily happen if that month had more freehold properties transacting at a higher psf as compared to leasehold.

We found an interesting point of comparison between The Orchard Residences, and St. Thomas Suites (both of which were highlight District 9 properties at their inception). Both were completed around 2010, and are about 1.5 kilometres apart. These two developments have 175 units and 176 units respectively.

(The Orchard Residences is much closer to the MRT, whereas St. Thomas Suites is about 10 minutes to Somerset MRT; but this pair was as close a comparison as we could find).

Now The Orchard Residences is 99-years leasehold, whereas St. Thomas Suites is freehold. Here’s how their prices moved:

Over the past 10 years, The Orchard Residences (the leasehold property) has depreciated from $3,498 psf, to $3,152 psf. This is a fall of 9.9 per cent, and an annualised loss of 1.04 per cent.

St. Thomas Suites (the freehold property) appreciated from $1,925 psf to $2,037 psf. This is a percentage gain of 5.82 per cent, or an annualised gain of 0.57 per cent; a clear win for the freehold property.

Basically, it’s not possible to conclusively show that freehold beats leasehold, or vice versa, when the leasehold properties are still new, or not yet past the middle of their lease.

It makes sense that – if all things stay equal and the properties really carry on till 99 years is reached – freehold will win.

But this scenario is more imaginary than real, and evidence is hard to find given that condos tend to go en-bloc before they even reach 40.

And over the initial period of 10 to 20 years, it’s hard to say which performs better.

For example, a leasehold property may suddenly start appreciating better than a freehold counterpart, if an MRT station appears next to it 10 years after TOP.

So if you want to make a smart decision, focus more on factors like accessibility, rentability and yields, and price. And if your exit strategy is to sell within 10 to 15 years of TOP, then freehold status may not matter (in fact freehold could make it worse, as you’d pay a 10 to 15 per cent premium that eats into your ultimate gains).

Developers do tend to use loss-leaders to get the ball rolling; that means you could find steeper discounts during the initial stages of a launch.

So in theory, if you’re an “early bird” buyer and get a discount, you’re “guaranteed” to make money once normal pricing is applied.

If you want to get a sense of what discounts are like, check out this earlier article.

There two risky assumptions behind this:

First, you’re assuming the developer won’t give future buyers equal or greater discounts. There’s no guarantee that they won’t, if sales are too slow (which is why there could be a risk with a not-so-reputable developer).

An oft-cited example this year is 38 Jervois, where fire sales were used to clear out remaining units. Buyers who purchased early for, say, a 10 per cent discount will definitely not be too happy to find out later buyers got discounts reaching 24 per cent.

Second, there’s no guarantee that when you sell in 10 or 15 years (or whenever your exit strategy is), the price wouldn’t have fallen.

For example, here are three District 9 condos that were hyped at the time of sale; and yet, they have chalked up million-dollar losses, more than negating any discount of earlier buyers.

If you wait till the property reaches top before buying from the developer, you should always be paying a higher price because of their pricing strategy. But don’t forget, buying late can mean using a Deferred Payment Scheme (DPS).

This would require a 20 per cent down payment, after which there could be no repayments due for another 24 months (and you can sometimes even rent out the property in those two years).

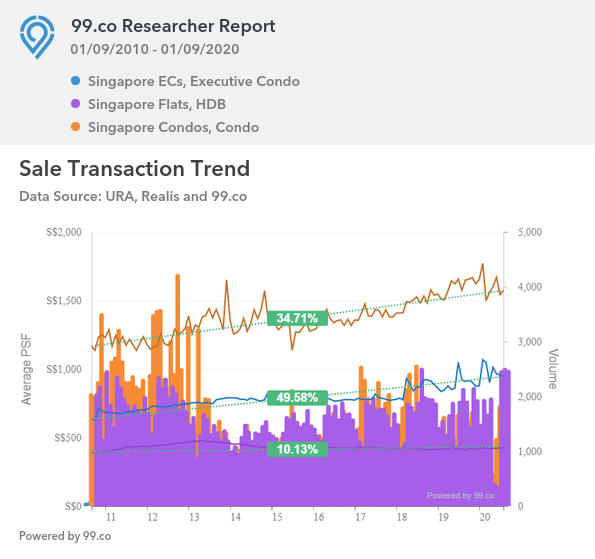

We have a more detailed examination of this, where we compared 53 ECs in Singapore. In general, yes, ECs have made money, and it’s quite rare that an EC unit doesn’t appreciate (when bought new).

However, the question is how much an EC appreciates, compared to properties like HDB flats and regular condos. Here’s a quick snapshot of the situation today:

Over a 10-year period, ECs across the island have appreciated from $631 psf to $944 psf. This is a percentage gain of around 49.6 per cent, or an annualised gain of 4.1 per cent.

At the same time, regular condos (freehold and leasehold) have appreciated from $1,165 psf to $1,569 psf. This is a percentage gain of around 34.7 per cent, or an annualised gain of three per cent.

Just out of curiosity, we checked out resale HDB flats too. In the same period, they appreciated from $390 psf to $429 psf, or about 10.1 per cent. This is an annualised gain of 0.96 per cent.

As an aside, note that 10 years ago, the price gap between ECs and regular condos stood at around 84 per cent. As of today, that gap has narrowed to about 66 per cent; so ECs do seem to be catching up.

Upgraders do form a sizeable portion of buyers.

Now if you buy a condo before selling your flat, you need to pay the Additional Buyers Stamp Duty (ABSD) upfront; you can get it back if you’re eligible for remission, and sell your flat within six months.

However, there’s no need to pay the ABSD upfront if you’re upgrading from a flat. This can be enticing to buyers who need to move in before selling their flat.

So overall, this saying does seem to have some truth to it. But as always, remember exceptions exist; some ECs even lose money right after their Minimum Occupation Period (MOP).

If you stay in it and generate no rental income, yes.

However, if you stay in it for the five-year MOP, and have somewhere else to live afterward (e.g. living with parents or in-laws, or your spouse has another property), you could generate much higher rental yields with your flat*.

For example, say you purchase a for-room flat in Queenstown, which has around 50 years left on the lease (around 45 years after your MOP).

Now there’s a very low volume of transactions for 50+ year old flats; from 2019, it’s varied from $424 to $475 psf. We’ll take the higher end of the range for now.

The average rental rate of a four-room flat in Queenstown is $2.61 psf as of September 2020 (tenants don’t care how many years are left on the lease, so the age is not a factor to them).

At a rental of $2.61 psf and cost of $475 psf, this is a gross rental yield of about 6.5 per cent (by comparison, most condos today have gross rental yields of between two to three per cent).

Even if you just hold the flat and rent it out over the next 50 years, there’s a chance you’ll see a good return and constant cash flow.

Of course, all of this assumes that you have the option of living somewhere else, while renting out the whole flat (and that you have no problems finding tenants).

*Note that only Singapore Citizens can buy a private property and also retain their flat, provided they reach the MOP. Permanent Residents must sell their flat within six months of buying a private home.

There’s usually a grain of truth in these sayings, but we should be careful not to oversimplify.

Property is a complex investment, involving many variables.

There are always exceptions to the truth, and the truths are not permanent (e.g. some concepts that applied in the 1990’s no longer apply to the market today, such as relying on compact units for quick sub-sale gains).

Take the sayings as a general start point, but always be ready to accept that your chosen property is an exception.

This article was first published in Stackedhomes.