Scion of UOB's Wee family buys GCB near Holland Village for $39.5 million

PUBLISHED ONApril 04, 2024 2:05 AMByKhoo Yi-Hang

PUBLISHED ONApril 04, 2024 2:05 AMByKhoo Yi-HangIt's more money than most would see in a lifetime and more space than what most can fill, but Grant Wee likely knew what he was doing when he forked out close to $40 million for a Good Class Bungalow (GCB) near Holland Village.

Grant Wee, scion of the Wee family and youngest child of United Overseas Bank chief executive officer Wee Ee Cheong, is buying a GCB on Ford Avenue for $39.5 million, reported Bloomberg on Wednesday (April 3).

This purchase has been set underway amid speculation of how the deceased Wee family patriarch, Wee Cho Yaw's US$10.6 billion (S$14.3 billion) fortune would be split among his children and grandchildren.

His father, Ee Cheong, reportedly holds a net worth of US$4.6 billion and is the richest of Wee's children, Bloomberg reported.

Ee Cheong is also one of the new faces on the Forbes list of global billionaires published on Tuesday (April 2).

According to that list, he has a net worth of US$1.6 billion and ranks 1,945 among the richest in the world.

Ee Cheong and his brothers, Wee Ee Chao and Wee Ee Lim, are among 39 billionaires from Singapore, reported The Straits Times today (April 4).

Grant himself is a former consultant at Boston Consulting Group and is currently running a wellness club in Singapore. Neither Grant nor Ee Cheong's two sons are involved in UOB's banking business.

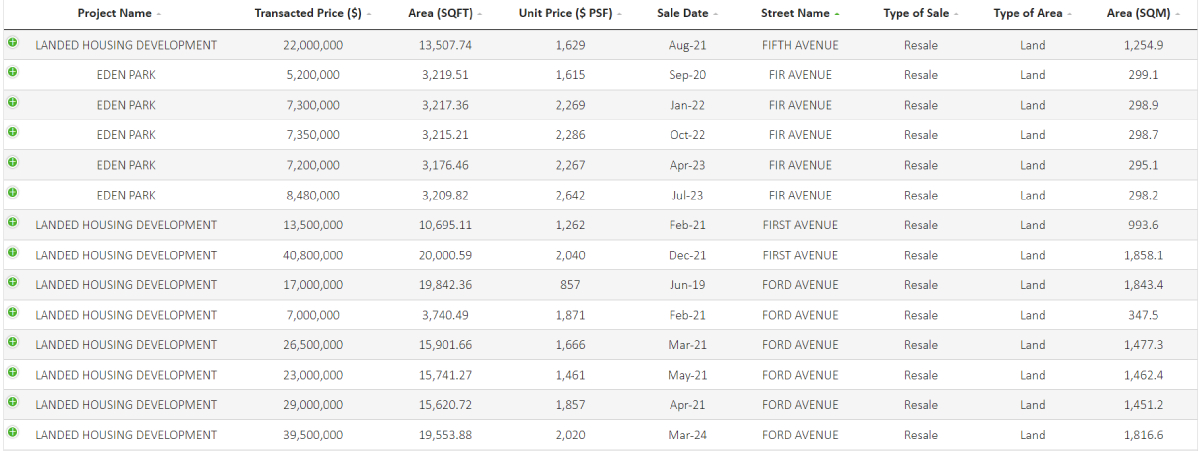

At about 1,816.6 sqm (19,547 sq ft), this Ford Avenue GCB is worth about $21,744 per sqm.

According to EdgeProp, the house is co-owned by Choo Chiau Beng who acquired the house in 2007.

Choo was the former CEO of the infrastructure entity now known as Keppel and was also Singapore's non-resident ambassador in Brazil.

During his time as CEO, there was a scandal regarding bribes made toward Brazil's state-controlled oil company Petroleo Brasileiro SA, The Straits Times reported in January 2018.

Keppel was reportedly made to pay US$422 million in fines as part of a resolution that saw the total sum split between Singapore, Brazil and the US, according to the US Department of Justice.

In Singapore, the Keppel unit involved in this scandal also accepted a conditional warning from the Corrupt Practices Investigation Bureau.

The Urban Redevelopment Authority's website shows that there have been multiple previous transactions for homes along Ford Avenue, with the most recent transaction going for $23 million for a 15,741 sq ft property.

Another Ford Avenue GCB was also put up for sale in January this year at $42.8 million for a 15,070 sq ft site, according to EdgeProp.

Despite indications of price growth, the transaction volume of GCBs has declined since 2023, hitting an all-time low since 1996, a study by CBRE released on March 26 determined.

Aside from being a status symbol, GCBs are considered a good defensive asset for the super-rich in Singapore that retain value during economic downturns and can be passed down to future generations, 99.co reported.

ALSO READ: Former National Development Minister Mah Bow Tan's GCB sold for $50m

khooyihang@asiaone.com