Top 5 undervalued Singapore dividend stocks (2020)

In the pursuit of dividends, many investors fall into the trap of purchasing stocks purely on a dividend yield basis. Many of these "high-yielding" stocks generated negative TOTAL returns (capital appreciation + dividend returns) over the mid to long term horizon.

In this article, we will be exploring 5 Undervalued Singapore dividend stocks. These stocks need to fulfil the following SIX key criteria: 1) Current dividend yield more than 4 per cent, 2) current market cap more than $200m, 3) Payout ratio less than 70 per cent, 4) 5-years of consistent dividend payments or DPS CAGR more than 20 per cent, 5) low net debt to equity and 6) Low Price to Earnings ratio.

We will be excluding REITs and the Singapore banks on this list. Companies with a high level of customer concentration risk will also be excluded.

Let's go through each of these six criteria briefly before disclosing our list of 5 Undervalued Singapore dividend stocks.

I want to be paid to wait and I believe that a 4 per cent dividend yield level is attractive in today's context where short-term government bond yields are all driven down to ZERO.

Within the Singapore context, the interest rate for the Singapore Savings Bond (SSB) over a 1-year horizon is currently at 0.96 per cent while over a 10-year horizon, that averages out to just 1.39 per cent.

If I view this as the closest alternative to the risk-free rate in Singapore, then generating a 4 per cent yield on a stock counter today would mean a more than 2.6 per cent spread over the 10-year rate. If the stock yield is the only criterion, then a 4 per cent yielding stock might not be extremely attractive.

However, if I am to combine it with other criteria which might indicate that the stock is undervalued, the total return of the counter has a high probability of outperforming the risk-free rate over a longer-term horizon.

I look to avoid overly small-cap stocks where there might be significant price volatility. Concurrently, for most small-cap counters, the focus will be on earnings growth vs. dividend stability.

Most small-cap stocks will be looking to reinvest their earnings for growth rather than pay out as dividends, the latter is more characteristic of stable mature companies that tend to generate lots of free cash but little scope for reinvestment into future earnings growth.

The dividend payout ratio is the percentage of a company's earnings paid to investors as cash dividends. It is only of the key indicators of the sustainability of a company's dividend payment stream.

A payout ratio consistently above 100 per cent could be a prelude to potential dividend cuts in the future.

However, there are always exceptions. Companies with a high level of depreciation tend to depress earnings. This might result in a payout ratio that is "artificially" high.

I typically find a payout ratio that is less than 70 per cent at a comfortable level. Ideally, I will like to find stocks where their payout ratio is less than 50 per cent for greater assurance of sustainability.

ALSO READ: Dividends can't lie; how you can use the dividend yield theory

It will not be very useful to evaluate the attractiveness of a dividend stock if the company does not have a consistent track record of paying and growing its dividends to shareholders.

Check to see if the company is paying a consistent dividend over the last 5 years. Ideally, I will like to see an increasing dividend per share (DPS) trend where DPS is steadily climbing over the past 5-years.

This shows that as the company grows its earnings, management is willing to "return" some of that earnings to shareholders in the form of a cash dividend.

Unfortunately, there are very limited quality SGX stocks with a consistently rising DPS payment.

In today's volatile market climate, a strong balance sheet position is critical to ensure survivability. There is no guarantee that firms will continue to have access to bank funding ahead.

In a scenario where funding liquidity dries up, significantly leveraged stocks will find themselves in trouble.

Hence, I look to identify counters with a strong balance sheet, characterised by a low net debt to equity ratio.

Many of the stocks in this list are in fact in a net cash position.

ALSO READ: 7 golden rules of dividend investing

The Price to Earnings ratio or the PER ratio for short is typically used to evaluate the "cheapness" of a counter.

This is defined as the Price of the counter / Earnings per share.

A low PER ratio tends to indicate a certain level of undervaluation although this should be evaluated on a sector to sector basis.

For example, REITs tend to have a high PER ratio, however, this sector is often not evaluated based on PER ratio. The healthcare sector typically also commands a much higher PER multiple relative to the industrial sector.

However, as a simple screening criterion, we look for stocks where the PER ratio is less than 15x on a forward basis, based on the market's latest forecast.

With that, these are the 5 Singapore dividend stocks that are potentially undervalued based on the 6 criteria above:

Current dividend yield: 4.1 per cent

Current market cap: $310 million

Payout Ratio: 30 per cent

5-years DPS track record: 2015: 0.01, 2016: 0.012, 2017: 0.017 (exclude special of 0.73 cts), 2018: 0.021, 2019: 0.030

Net debt/equity: Net cash

PER multiple: 8.1x

Frencken Group is a global high-tech capital and consumer equipment service provider. The company has two key business divisions: 1) Mechatronics and 2) IMS.

Within the two business divisions, the company operates in 5 business segments: 1) Semiconductor, 2) Medical, 3) Analytical, 4) Industrial Automation and 5) Automotive.

The diversification across these business segments ensures that the company is not overly reliant on any particular business entity as well as exposed to customer concentration risk.

The table below shows the 1Q20 revenue guidance provided by management and compiled by CIMB.

The guidance was of course given before the significant deterioration in the Covid-19 situation. According to DBS Vickers latest forecast, earnings for Frencken are expected to decline by 19 per cent YoY to $38 million for 2021.

Based on the current market cap of $308 million, that is still a respectable forward PER multiple of 8.1x.

The company has guided that its plants in China are back to normal operation while its factories in Malaysia are partially affected by the Movement Control Order.

With its strong balance sheet where the company is in a net cash position, Frencken is in a much better position to weather the current macro volatility due to Covid-19.

Taking into consideration its strong balance sheet position and the fact that the dividend payout ratio is only 30 per cent, Frencken is in a comfortable position to at least maintain its 2019 DPS of $0.030 by increasing its payout ratio marginally to 35 per cent, even at a lower EPS forecast of $0.089 by DBS Vickers.

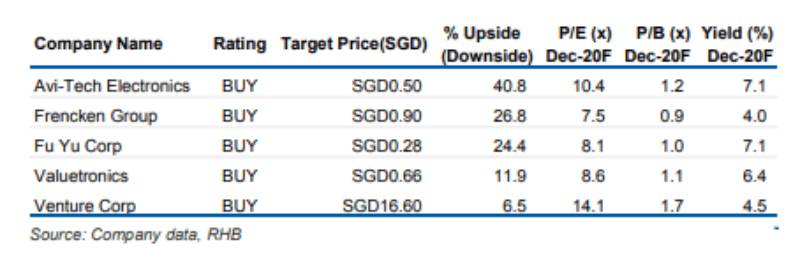

The counter has rebounded significantly from its recent low of $0.48 and is currently trading at $0.72. With a forward PER that is still among the lowest vs. peers according to RHB’s latest research on April 15, investors should look to purchase the counter on dips when the opportunity arises.

Current dividend yield: 4.4 per cent

Current market cap: S$4.6bn

Payout Ratio: 56 per cent

5-years DPS track record: 2015: 0.5, 2016: 0.5, 2017: 0.5, 2018: 0.8, 2019: 0.7

Net debt/equity: Net cash

PER multiple: 14.3x

Venture is a blue-chip OEM manufacturer in Singapore with a large clientele base of MNCs. Nonetheless, the company is not spared from the supply chain disruption due to Covid-19. Its factories in Malaysia remain impacted by the Movement Control Order and this will likely hurt its production in 1H20.

According to RHB, Venture’s management expects its outlook to improve in 2H20, supported by traction with new and existing partners.

This will also be supported by several product introductions by existing partners across multiple technology domains like life sciences, healthcare & wellness, instrumentation & networking, and communications.

A key customer of Venture has been Philip Morris where the company is one of two/three key suppliers of the latter’s IQOS device. Philip Morris remains buoyant that consumable unit sales of its IQOS will hit the 90-100bn target in 2021 based on the company’s last update I nearly February.

[[nid:484928]]

This should bode well Venture, particularly if Philip Morris reiterates its positive stance on IQOS in its upcoming 1Q20 results.

Other key customers of Philip Morris such as Illumina, Agilent Technology, Keysight Technology (blue chip-life US tech companies) have all seen their share prices rebound strongly from the recent sell-down.

While RHB is cutting its 2020 earnings forecast of Venture by 13 per cent to $318 milloin, this still implies a decent 14.3x forward PER ratio.

Management has guided that it is looking to pay out a sustainable dividend. Coupled with the fact that its balance sheet is in a net cash position, I believe that the $0.70 DPS could potentially be sustainable in 2020.

Venture could be one of the key global blue-chip OEM that will not only survive the Covid-19 crisis but could emerge as a much stronger entity, taking market share from its weaker and more debt-laden peers.

For a more contrarian view, do check out Maybank’s latest research where the brokerage house downgrades the counter to a SELL but maintains its long-term constructive outlook for the company.

The brokerage house preferred tech play in AEM, UMS, and Valuetronics. AEM, a popular retail stock, is not in this list of preferred dividend stocks as its yield of 2.4 per cent is below our 4 per cent consideration level.

The counter also has a high customer concentration risk in Intel. UMS is another semiconductor that fares well in the screening criteria but not in our list due to its high revenue exposure (80-90 per cent) to one US-based customer, Applied Materials.

Current dividend yield: 6.9 per cent

Current market cap: $200 million

Payout Ratio: 58 per cent

5-years DPS track record: 2015: 0.0275, 2016: 0.0275, 2017: 0.0275, 2018: 0.0275, 2019: 0.0275

Net debt/equity: 0.25x

PER multiple: 10.2x

CSE Global is a leading systems integrator targeting the oil and gas, petrochemical, utilities, public infrastructure, environmental and healthcare industries.

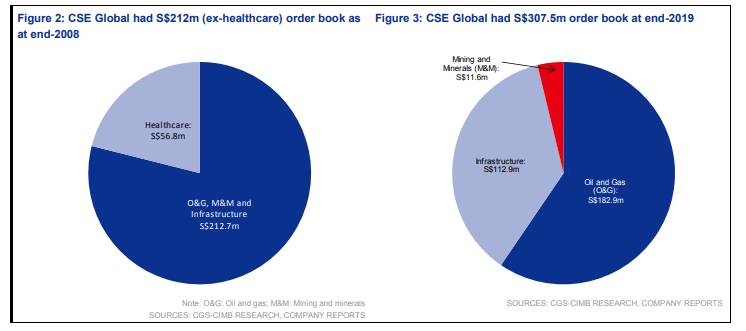

With the substantial fall in oil prices, it is not surprising that CSE Global’s share price has also taken a beating, given that its substantial exposure to the oil and gas industry which encompass almost 60% of its order backlog.

Due to the depressed oil prices, many oil companies are planning to reduce their CAPEX and this is likely going to have a flow-through impact for CSE Global, which has been on a roll lately, with its new order wins near historical high level in 2019.

New order wins in 2020 should fall back to at least the 2016 level, similar to the slump in oil prices back then. However, if oil demand destruction becomes structural, sustained low oil prices might be here to stay and this will hurt future new orders for CSE Global in the coming years.

The company also has a rather substantial exposure to US shale players, many of which might not be in existence if oil prices remain at such low prices in the coming months/quarters.

CIMB is forecasting a 30 per cent decline in CSE Global’s 2020 earnings to $19.7 million.

However, the brokerage house is maintaining its DPS forecast at $0.0275/annum for 2021-2023, largely due to CSE Global’s strong balance sheet position where it is in a slight net debt/equity (0.25x). The yield of close to 7 per cent, if DPS maintains, is seen as a strong share price support.

With a sufficiently strong order backlog of $308 million as of end-2019, there should be good revenue visibility in 2020. However, one should look out for potential trouble brewing within its key oil & gas sector.

Current dividend yield: 4.6 per cent

Current market cap: $880 million

Payout Ratio: 50 per cent

5-years DPS track record: 2015: 0.027, 2016: 0.034, 2017: 0.064, 2018: 0.098, 2019: 0.143

Net debt/equity: 0.25x

PER multiple: 10.9x

SBS Transit is Singapore’s key transport operator of bus, rail and taxi services. The company is the majority (75 per cent) owned by Comfort Delgro.

The Covid-19 pandemic which resulted in the implementation of the circuit breaker here in Singapore for a duration of approx. one month will undoubtedly impact SBS transit operational performance in 1H20.

[[nid:474855]]

However, the counter’s share price has declined from $4+ back in 2019 to the current level of $2.90, which is close to a 30 per cent price depreciation for a relatively defensive price counter which has also been a steady dividend payer over the years.

The long-term outlook for the company remains a positive one although its short-term earnings performance will be negatively impacted, both from the revenue front due to lower ridership as well as on the cost front where the company needs to replace an aging bus and train fleet as well as attract and retain staff.

The ongoing refurbishing of the trains of the North East MRT Line and Sengkang Punggol LRT will push up repair and maintenance costs in 2020.

There is currently no analyst directly covering SBS Transit due to the counter’s low free float. Based on historical earnings, the counter is trading at approx. 11x. This multiple should increase to around 15x on a forward basis.

Nonetheless, if one believes in the resilience of the Singapore public transport system, then SBS transit should be a decent buy at levels below $3 with a longer-term view.

On technicals, $2.50 is now seen as a key strong support level, one that has held up well in the recent sell-down and a major resistance turn support level from 2017-2019.

With a balance sheet that is marginally in a net debt position, spotting a net debt to equity multiple of 0.25x, SBS transit remains in a comfortable position where we foresee no credit risk.

Its dividend payout ratio of 50 per cent remains comfortably below our threshold of 70 per cent and we see some scope for its 2020 dividend to be maintained at 2019 level.

SBS Transit is one of the few SGX companies that has been consistently increasing its DPS over the past 5-years.

Current dividend yield: 7 per cent

Current market cap: $270 million

Payout Ratio: 43 per cent

5-years DPS track record: 2015: HKD0.2, 2016: HKD0.2, 2017: HKD0.27, 2018: HKD0.25, 2019: HKD0.26

Net debt/equity: Net cash

PER multiple: 8x

Valuetronic’s origin started as an integrated manufacturing service provider for its customers but has since scaled the value chain with more in-depth engagement with its customers in the arena of design and development of products.

The company operates in 2 key divisions: 1) Consumer Electronics (CE) and 2) Industrial and Commercial Electronics (ICE).

Revenue between both divisions is now skewed towards the higher-margin ICE division vs. a few years back where the lower-margin CE division dominated the bulk of the Group’s revenue.

[[nid:480006]]

The subsequent decline of LED lighting demand from Philips resulted in both revenue and earnings disappointment as its share price took a tumble in 2014-15.

With demand from mass-market LED lighting dwindling, the company refocuses its attention on diversifying its revenue base through higher-margin projects from the ICE division.

Revenue from this segment subsequently increased from c.30 per cent of Group’s revenue to the current level of 60 per cent (based on FY19), with Valuetronics also benefitting from margins improvement due to better sales mix.

This division also does not present customer concentration risk with no single client encompassing more than 10 per cent of Group’s revenue.

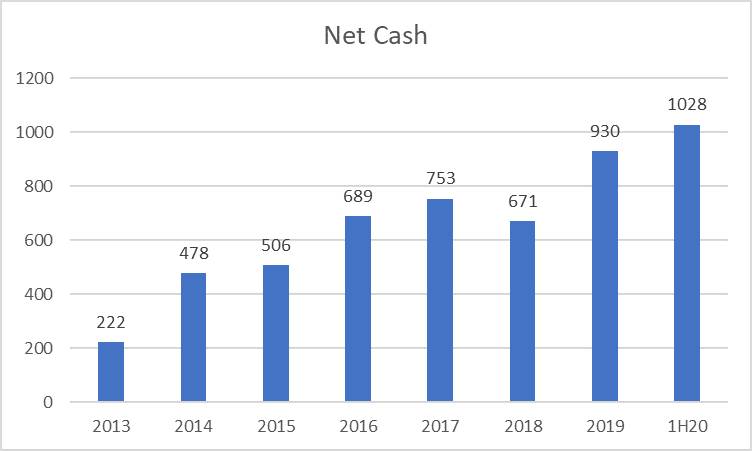

The company has been growing its net cash profile over the years, with net cash increasing from HKD222m in FY13 to HKD1028m in 1HFY20. Current net cash accounts for approx. 70 per cent of its market cap!

Given its strong balance sheet with a huge cash hoard (likely the envy of many debt-heavy companies), I believe Valuetronics have a bigger than even chance to emerge out of this crisis, not only unscathed but also to gain market share from weaker competitors, many of whom might not survive this current downturn.

The company has marginally reduced its DPS from HKD0.27 in FY18 to HDK0.25 in FY19.

Assuming that its final 4QFY20 quarter is a wash-out with zero earnings, FY20 earnings could be approx. HKD170m which translates to c.HKD0.40 EPS. This will be a 15% decline from FY19 EPS of HKD0.462.

I assume a payout ratio of 60 per cent, that will translate to DPS of HKD0.24 for FY20, marginally lower than FY19 DPS of HKD0.25.

At HKD0.24/share in dividends, this translates to an attractive yield of 7 per cent for the counter at the current price.

RHB recently upgraded the counter from Hold to Buy, believing that the worst is over for the company. As of March 23, 80 per cent of Valuetronics employees have resumed work.

These are the 5 undervalued Singapore dividend stocks that investors could consider to purchase on dips. Amid the current market volatility, their best-in-class balance sheet ensures that these companies will remain in existence when funding liquidity dries up.

While earnings visibility is currently low, investors looking to purchase these counters should be comfortable in the companies’ long-term fundamentals.

With a yield of at least 4 per cent, investors are paid to wait on these companies as the health pandemic storm blows over. In a positive scenario, they will emerge not only unscathed but with a higher market share as they capitalise on weaker peers exiting from the industry.

This article was first published in New Academy of Finance. All content is displayed for general information purposes only and does not constitute professional financial advice.