NTUC Income travel insurance review: Covid-19 coverage, pre-existing conditions, premiums

What do you think of when you hear the acronym "NTUC"? The FairPrice supermarket, of course, said every self-respecting auntie ever. But frequent travellers might also think of NTUC Income's popular travel insurance plan since they are one of Singapore's biggest travel insurance providers.

However, NTUC Income travel insurance plans also have a reputation for being expensive. Some internet users have also complained that it is difficult to make claims.

Are these rumours true? Let's find out once and for all.

NTUC Income has two travel insurance plans:

Each travel insurance plan is then further sub-divided into three plan tiers which provide different amounts of coverage:

The premiums you will pay for your travel insurance plan largely depend on the country you’re travelling to. Usually, the further your country of destination, the more expensive your travel insurance plan will be. Here are the countries that are covered by NTUC travel insurance:

Countries not covered: Afghanistan, Iraq, Liberia, Sudan, Syria

Here’s a quick look at the premiums and coverage for the NTUC Travel Insurance Standard plans:

| NTUC Travel Insurance | Classic | Deluxe | Preferred |

| Price (Asean) | $61/week | $75/week | $98/week |

| Price (Asia) | $70/week | $88/week | $122/week |

| Price (Worldwide) | $137/week | $156/week | $195/week |

| Overseas medical expenses | $250,000 | $500,000 | $1,000,000 |

| Emergency medical evacuation | $500,000 | Unlimited | Unlimited |

| Personal accident (death, TPD) | $150,000 | $200,000 | $500,000 |

| Travel delay ($100/6 hours) | $1,000 | $1,500 | $2,000 |

| Trip cancellation | $5,000 | $10,000 | $15,000 |

| Baggage delay ($200/6 hours) | $1,000 | $1,200 | $2,000 |

| Baggage loss | $3,000 | $5,000 | $8,000 |

| Sports & Adventure | Some (Scuba diving, hiking, skiing covered) | ||

| Covid-19 | Yes | ||

At $250,000 to $1,000,000, NTUC travel insurance's overseas medical coverage is generous compared to some of its competitors such as Sompo Travel Insurance's $200,000 to $400,000 overseas medical limit.

However, do note that emergency medical evacuation shares the same overseas medical expense claim limit for adults aged 70 and over — which may not be sufficient if you are in that age range, run into an adverse medical situation abroad, and require both immediate treatment and a medical flight home to Singapore. If medical coverage is important to you, FWD Travel Insurance offers unlimited medical evacuation and repatriation coverage.

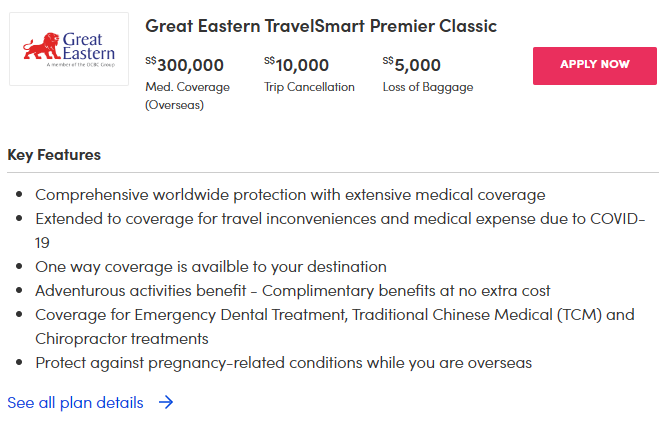

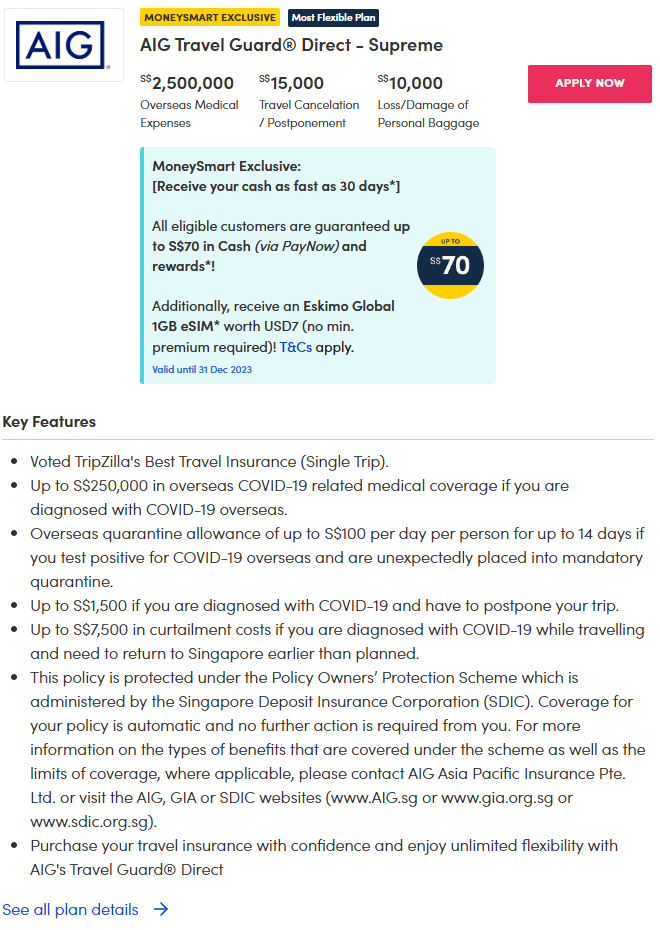

One great advantage of NTUC Income's travel insurance is the high trip cancellation coverage ranging from $5,000 to $15,000. Other travel insurance providers might not be so generous. For instance, Great Eastern is offering $2,000 to $15,000, while AIG offers $2,500 to $15,000.

NTUC Income is one of the few insurers in Singapore that provide comprehensive travel insurance plans that cover pre-existing medical conditions, such as asthma, eczema, diabetes, high blood pressure, even heart disease. The other two that cover pre-existing conditions are MSIG travel insurance and Etiqa travel insurance.

The most obvious difference between a Pre-Ex travel insurance plan and a regular travel insurance plan is, of course, price. The cheapest NTUC PreX plan costs over twice the price of a regular NTUC travel insurance plan!

For those who have major health problems, you don't have much of a choice. There's no point buying a cheap normal insurance with no coverage for you at all because you definitely will not be able to claim medical expenses, evacuation costs or travel delays linked to a flare-up of your condition.

It is especially worth the money if your condition is either life-threatening or very expensive to treat overseas.

However, if you have a condition that's pure suffering not immediately life-threatening, such as eczema, then it is your choice whether you want to spend more on Pre-Ex travel insurance for better coverage.

It's important to look at the coverage limits if you're seriously considering pre-existing travel insurance. Why? If you're travelling to somewhere with really expensive healthcare, like Europe or the US, you might want to upgrade to the Enhanced PreX Prestige plan.

| NTUC Enhanced PreX Travel Insurance | Basic PreX | Superior PreX | Prestige PreX |

| Price (ASEAN) | $102/week | $128/week | $149/week |

| Price (Asia) | $121/week | $156/week | $183/week |

| Price (Worldwide) | $194/week | $240/week | $277/week |

| Overseas medical expenses | $500,000 | $500,000 | $1,000,000 |

| Emergency medical evacuation | Unlimited | Unlimited | Unlimited |

| Personal accident (death, TPD) | $200,000 | $200,000 | $500,000 |

| Travel delay ($100/6 hours) | $1,500 | $1,500 | $2,000 |

| Trip cancellation | $10,000 | $10,000 | $15,000 |

| Trip postponement | $1,000 | $1,000 | $2,000 |

| Baggage delay ($200/6 hours) | $1,200 | $1,200 | $2,000 |

| Baggage loss | $5,000 | $5,000 | $8,000 |

| Sports & Adventure | Limited (scuba diving, hiking, skiing covered) | ||

| Covid-19 | Yes | ||

Is NTUC's travel insurance for pre-existing medical conditions any good? For one, NTUC PreX travel insurance covers Covid-19 while MSIG Pre-Ex and Etiqa Pre-Ex don't cover you for Covid-19. So, if you want both pre-existing medical conditions and Covid-19 coverage in your travel insurance, NTUC Enhanced PreX is your only choice.

Even though NTUC Pre-Ex travel insurance offers you Covid-19 coverage, the downside is that they've lowered the medical benefits you get if you're aged 70 and above.

For example, for those aged 70 and above NTUC PreX's overseas medical and emergency medical evacuation coverage share a total claim limit of $500,000 for its basic plan tier (as opposed to up to $250,000 in overseas medical expenses and $500,000 in medical evacuation coverage for under 70s).

By comparison, MSIG Pre-Ex basic offers $250,000 / $50,000 medical (below 70 / above 70) and $1,000,000 evacuation regardless of age, while Etiqa Pre-Ex basic offers $200,000 medical and $1,000,000 evacuation and repatriation of mortal remains.

Otherwise, NTUC PreX's miscellaneous trip cancellation and baggage delay benefits are pretty good.

Whether you buy an NTUC Travel Insurance Standard or an NTUC Enhanced PreX Travel Insurance plan, you'll be relieved to know that all NTUC travel insurance plans automatically come with Covid-19 coverage.

You won't find the Covid-19 coverage table in the usual NTUC travel insurance policy wording. Instead, there's a separate NTUC travel insurance Covid-19 policy wording document that you should refer to.

| NTUC Travel Insurance Covid Coverage (covers PreX) | |

| Trip cancellation | $2,000 |

| Trip postponement | $2,000 |

| Trip shortening | $2,000 |

| Trip disruption | $1,000 |

| Medical expenses overseas | $150,000 |

| Emergency medical evacuation | $150,000 |

| Overseas quarantine allowance ($100/day) | $1,400 |

Few of us really scrutinise the individual coverage limits on our travel insurance, trusting that they do cover the bare essentials.

The good news is that NTUC travel insurance's Covid-19 extension is simple, and adequate. Take Covid-19 overseas medical coverage for example, NTUC offers $150,000 while MSIG' basic plan offers $75,000. Then, there's overseas Covid-19 quarantine cash allowance, which NTUC gives $100 per day, up to $1,400, but Etiqa's basic plan offers $100 per day, up to $500 only.

Since our last review in July 2022, NTUC has updated its Travel Insurance policy to include more common vacation activities like scuba diving and skiing.

Nevertheless, extreme thrill seekers may want to go for a more lenient insurance provider such as Direct Asia travel insurance, which properly covers extreme sports and martial arts.

| Extreme Sports & Outdoor Adventure | NTUC Travel Insurance |

| Hot air balloon | Not stated |

| Scuba diving | Yes (up to 30m) |

| Skiing and other ice/snow sports | Yes |

| Hiking or trekking | Yes (up to 4,000m) |

| Mountaineering or outdoor rock climbing | No (but man-made walls are ok) |

| Marathons and other competitions | Yes |

| Jet skiing | Not stated |

| White water rafting | Yes |

| Skydiving | Yes |

| Paragliding, hang gliding or parachuting | Yes |

| Bungee jumping | Yes |

To be honest, NTUC Travel Insurance is adequate if you're looking to snorkel or join a guided tour group with a licensed outdoor adventure operator. But if you’re a hardcore adrenaline junkie… you might want to look around instead.

If you’re considering NTUC travel insurance, you should be comparing it against established household insurance providers such as MSIG and Etiqa.

| NTUC Travel Insurance | MSIG Travel Insurance | Etiqa Travel Insurance | |

| Price (per week) | $61 – $195 | $62 – $208.50 | $58-280 |

| Covid-19 (per week) | Included | Included | Included (non pre-ex plans only) |

| Medical Expenses (Overseas) | $250,000 – $1,000,000 | $250,000 – $1,000,000 | $200,000 – $2,500,000 |

| Emergency Medical Evacuation | $500,000 – unlimited | $1,000,000 | $500,000 – Unlimited |

| Trip Cancellation | $5,000 – $15,000 | $5,000 – $15,000 | $5,000 – $15,000 |

| Baggage Loss | $3,000 – $8,000 | $3,000 – $7,500 | $3,000 – $10,000 |

All 3 insurers, NTUC, MSIG, and Etiqa offer Covid-19 coverage in their travel insurance plans automatically. Other plans that include automatic Covid-19 coverage include Starr TraveLead Comprehensive, Bubblegum Travel Insurance, Singlife Travel Insurance and DBS Chubb Travel Insurance.

In terms of overseas medical expenses, MSIG offers comparable coverage to NTUC's travel insurance. When it comes to other travel and logistics-related coverage such as trip cancellation and baggage loss, NTUC and MSIG travel insurance plans' coverage are also pretty much on par.

All things considered, NTUC and MSIG travel insurance plans are shockingly similar and competitive. A key difference is emergency medical evacuation coverage for people aged 70 and over-NTUC travel insurance parks that under the overseas medical expense limit.

When you pit NTUC travel insurance against one of the most popular "budget" travel insurance providers, FWD, you'll realise that the travel insurance offerings are very similar and competitive.

| NTUC Travel Insurance | FWD Travel Insurance | |

| Price (per week) | $61 – $195 | $31.50 – $101.62 |

| Covid-19 (per week) | Included | $11.39 – $20.04 |

| Medical Expenses (Overseas) | $250,000 – $1,000,000 | $200,000 – $1,000,000 |

| Emergency Medical Evacuation | $500,000 – Unlimited | Unlimited |

| Trip Cancellation | $5,000 – $15,000 | $7,500 – $15,000 |

| Baggage Loss | $3,000 – $8,000 | $3,000 – $7,500 |

Between NTUC travel insurance and FWD travel insurance, coverage is actually largely on par if you're considering a basic travel insurance plan with Covid-19 coverage. However, FWD's prices are lower even if you purchase the Covid-19 add-on.

At a glance, here’s how NTUC Income's travel insurance stacks up compared to the other major travel insurers in Singapore.

| NTUC Travel Insurance | MSIG Travel Insurance | Etiqa Travel Insurance | FWD Travel Insurance | Starr Travel Insurance | Direct Asia Travel Insurance | AIG Travel Insurance | Allianz Travel Insurance | Bubblegum Travel Insurance | |

| Price (per week) | $61 – $195 | $62 – $208.50 | $58-280 | $31.50 – $101.62 | $20.40-$48 | $35-$98.08 | $34-$187 | $64-$237 | $42.12-$52.65 |

| Covid-19 (per week) | Included | Included | Included | $11.39 – $20.04 | Included | $13.73-$31.70 | Included | Included | Included |

| Medical Expenses (Overseas) | $250,000 – $1,000,000 | $250,000 – $1,000,000 | $200,000 – $2,500,000 | $200,000 – $1,000,000 | $200,000-$1,000,000 | $150,000-$500,000 | $100,000-$2,500,000 | $250,000-$1,000,000 | $150,000 |

| Emergency Medical Evacuation | $500,000 – unlimited | $1,000,000 | $500,000 – Unlimited | Unlimited | Unlimited | $1,500,000 | $50,000-Unlimited | $1,000,000 | Unlimited |

| Trip Cancellation | $5,000 – $15,000 | $5,000 – $15,000 | $5,000 – $15,000 | $7,500 – $15,000 | Optional add-on | $3,000-$15,000 | $5,000-$15,000 | $5,000-$10,000 | $5,000 |

| Baggage Loss | $3,000 – $8,000 | $3,000 – $7,500 | $3,000 – $10,000 | $3,000 – $7,500 | Optional add-on | $1,000-$5,000 | $3,000-$10,000 | $1,500-$5,000 | $3,000 |

Even though many Singaporeans probably don't mind paying more for NTUC travel insurance just because it's a household brand name, their travel insurance plans are actually pretty expensive.

However, with ongoing promotions like the current 45 per cent discount promo, it can be value for money. All standard per-trip plans qualify for the promo. For example, if you wanted to go temple-hopping for a week in Myanmar, the cheapest Classic plan would cost just $33.55 after the discount. Here are the premiums you'll be paying with the current 45 per cent discount promo:

| NTUC Travel Insurance (45per cent discount) | Classic | Deluxe | Preferred |

| Price (Asean) | $33.55/week | $41.25/week | $53.90/week |

| Price (Asia) | $38.50/week | $48.40/week | $67.10/week |

| Price (Worldwide) | $75.35/week | $85.80/week | $107.25/week |

In addition, Income is offering an additional 15per cent off Enhanced PreX per-trip plans with complimentary personal accident coverage for six months.

If you follow insurance threads on forums or even talk to your friends about insurance claims over kopi, you might have gotten wind of NTUC Income's bad claims reputation.

Unfortunately, online forums such as Hardwarezone and Reddit are full of similar stories from users claiming that their NTUC insurance claims were slow, long-drawn-out and plagued with difficulties. According to the users' NTUC claim experiences, there was a lot of emphasis on the need for original invoices to be submitted.

To be fair, between these nasty stories, you'll also find users who managed to claim from NTUC insurance smoothly and received their cheques in the mail.

So, how do you make a claim? Your first port of call should be to get in touch with NTUC Income ASAP.

NTUC Travel Insurance Emergency hotline: Call the NTUC emergency assistance hotline at +65 6788 6616

Here's where it gets confusing. You have to identify the type of claim that you're making and the "correct" way to submit it. Super important: all claims must be made within 30 days of the event or incident.

NTUC Travel insurance online claims: Submit NTUC travel insurance claims online with supporting documents such as invoice, flight itinerary, police report, etc. through their website. You can do so for the following benefits:

NTUC Hard copy claims: For medical expenses, you need to fill in the NTUC travel insurance claim form and drop off the hard copy form with the supporting documents such as hospital bill, medical report, boarding pass, etc. at an NTUC Income branch.

NTUC Email claims: For claims that do not involve travel inconveniences (see above) and medical expenses (see above), you’ll need to fill in the NTUC travel insurance claim form digitally, and email it together with your supporting documents to pcc@income.sg. Include your travel policy number in the subject line.

NTUC Claims settlement time: If there is no dispute, NTUC Income will settle your claims within 10 working days or longer during high-volume travel periods like school holidays.

NTUC travel insurance isn't the absolute cheapest around, but their regular travel insurance plans are very affordable and value for money when there's a 45 per cent promotion going on.

However, just because it's a brand name doesn't mean that their coverage is the highest in town, especially when you compare it with newcomers like FWD. That's not a problem for most travellers though, unless you're going to a super expensive country or encounter some unusual scenario.

For most Singaporeans who just want to eat, chill and relax on holiday, NTUC travel insurance is more than adequate especially as it also provides Covid-19 coverage. However, daredevils should take note that it does not cover more thrilling activities like mountaineering and other extreme sports.

If you have a pre-existing medical condition, NTUC Enhanced PreX is one of the very few travel insurance options suitable for you. It is pricey for sure, but probably worth the money if you have a life-threatening condition like asthma or heart disease. Make sure that the plan is sufficient to cover your overseas expenses and/or evacuation.

ALSO READ: How travel insurance can protect your refund rights for flight cancellations and delays

This article was first published in MoneySmart.