We make $15k per month and live in a 4-room HDB flat. Should we upgrade to a condo now once interest rates drop?

Hi Ryan,

Really like the outreach that you’ve done.

I do have a couple of questions which I would appreciate your expert opinion on. It might even serve as reference/ inspiration for content down the road:

My husband and I have two young children and we live in a 4 room HDB in Buangkok. This is our first home and we purchased it back in 2017 for close to $500K. When we first bought the place, it was just my husband and I, but now with two kids (and a helper) in tow, we badly need the additional room. Not too concerned with the sq. metres, just as long as we have 3 bedrooms + 1 study/additional room.

That said, we have been toying with the idea of upgrading to a private property (EC/condo) but we aren’t too sure where to start and if it’s even a wise choice given our current salaries – we both have a combined income of $15,000 (incl. CPF). We have a $900 car loan and are about halfway through on paying up our current mortgage loan.

Given that we bought our current place at a relatively high price, we’re not certain we can profit much or even at all when we sell it. While we can’t be of the mindset of selling a home and turning a profit, that would always be an ideal situation, especially since the plan is for us to upgrade.

My questions here are:

1) Would it be worth stretching ourselves financially to purchase a 4 bedroom EC/condo once the home interest rates come down? And is this even possible and how much of a loan/ cash down payment do we need given our current income? The long term plan would then be for us to sell our private property and then downgrade to a smaller HDB once our children are older.

2) With the high interest rates on home loans and the slew of cooling measures implemented by the government, how will this affect HDB home owners who are looking to sell their flat for a higher profit?

Your advice here would be much appreciated!

Editor’s Note: Some details provided by the couple have been removed for privacy reasons.

Thanks!

Hey there,

Thanks for writing in with your questions.

We understand with rising inflation, mortgage rate hikes, and high property prices, it can be a daunting time to consider moving especially with two little ones. We will run through the figures with you and hopefully help you can make a more informed decision going forward.

Let’s start by looking at how your current HDB is performing.

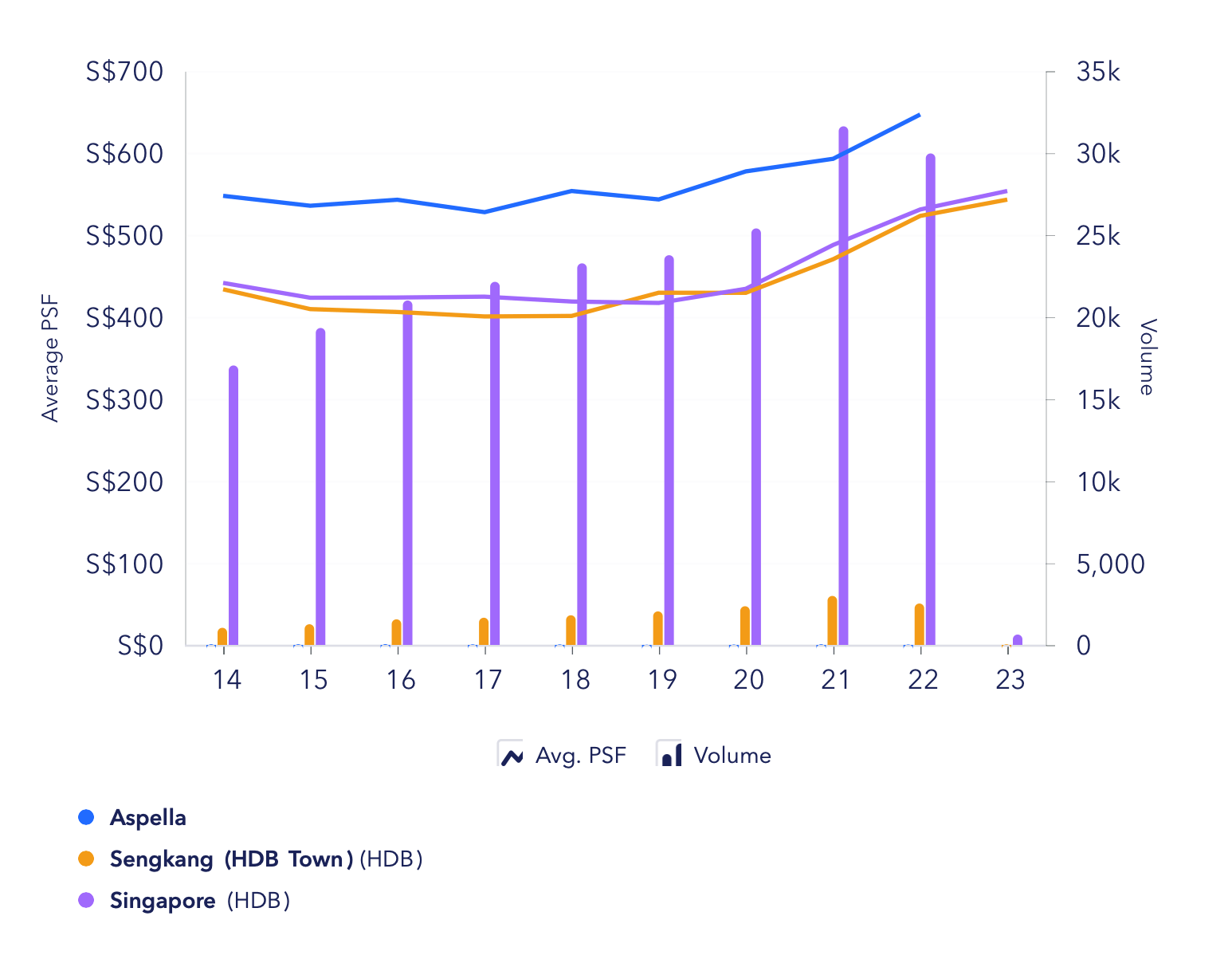

We can see from the graph above that the price movement of flats in your cluster (Aspella) is more or less in line with the price movement of flats in Sengkang as well as the wider market. Prices at Aspella started picking up in 2019 while overall HDB prices in Sengkang only started picking up in 2020.

This is due to the launch of Sengkang Grand Residences, a mixed development with residential and commercial components. A new shopping mall definitely increases the convenience of the area and seeing as Aspella is located right across the upcoming development, it will stand to benefit from this.

Here are some recent 4-room transactions in Aspella:

| Date | Block | Level | Size (sqm) | Price |

| Jan 2023 | 277C | 13 to 15 | 92 | $698,888 |

| Dec 2022 | 275B | 13 to 15 | 90 | $690,000 |

| Dec 2022 | 277D | 01 to 03 | 90 | $620,000 |

| Nov 2022 | 275B | 04 to 06 | 90 | $605,000 |

| Nov 2022 | 275C | 13 to 15 | 90 | $750,000 |

| Nov 2022 | 275D | 07 to 09 | 92 | $678,000 |

| Nov 2022 | 277A | 07 to 09 | 90 | $680,000 |

| Oct 2022 | 277C | 10 to 12 | 92 | $690,000 |

| Sep 2022 | 275D | 01 to 03 | 90 | $608,000 |

As compared to six years ago, prices have gone up but this does not necessarily mean you’ll make a profit; so let’s check on your potential sales proceeds should you decide to sell:

| Description | Amount |

| Sale price (Average based on above transactions) | $668,876 |

| Outstanding loan | $318,208 |

| CPF used plus accrued interest | $248,755 |

| Cash proceeds | $101,913 |

Let’s now take a look at your affordability after selling:

| Description | Amount |

| Maximum loan based on ages 33 and 34 with a combined monthly income of $15K and $900 car loan | $1,539,540 (30 years tenure) |

| CPF funds (refunded from the sale of the HDB, not including any that you may have in your OA) | $248,755 |

| Cash | $101,913 |

| Maximum affordability based on 25per cent downpayment of $350,668 (CPF + Cash) | $1,402,672 |

| BSD based on $1,402,672 | $40,707 |

| Estimated affordability | $1,361,965 |

Due to the amount of CPF + Cash (which makes up the 25 per cent downpayment) that you have, you will not be able to take the maximum loan

If you were to purchase a property at $1.36 million:

| Description | Amount |

| Purchase price | $1,360,000 |

| CPF + Cash | $350,668 |

| Loan | $1,009,332 |

| Monthly repayment based on 4per cent interest and 30-year tenure | $4,819 |

With a budget of $1.36 million, these are some available four bedders on the market:

| Project | District | Tenure | Completion year | Size (sqft) | Asking price |

| Symphony Suites | 27 | 99 years | 2019 | 1023 | $1,300,000 |

| Bellewoods | 25 | 99 years | 2017 | 1152 | Starting from $1,340,000 |

| La Casa | 25 | 99 years | 2008 | 1259 | $1,230,000 |

| Regent Heights | 23 | 99 years | 2000 | 1259 | $1,350,000 |

| Palm Gardens | 23 | 99 years | 2000 | 1346 | Starting from $1,300,000 |

If you were to also do a search on PropertyGuru, you’ll see that there are a few resale EC units that fall within your budget. However, these units have not met their MOP but have gotten special approval from HDB to sell early.

And so for these units, the loan amount will be computed based on MSR instead of TDSR and a resale levy will be payable if you are a second-timer.

Here’s a look at actual four-bedroom transactions for condos that are 10 years or younger in the past 6 months:

| Project | Price | Size | $PSF | Date | Type | Tenure | Built Year |

| SEA ESTA | $1,217,000 | 1,206 | $1,009 | 26 Jul 2022 | Condominium | 99 yrs from 09/01/2012 | 2015 |

| TWIN FOUNTAINS | $1,250,000 | 1,206 | $1,037 | 25 Jul 2022 | Executive Condominium | 99 yrs from 19/12/2012 | 2016 |

| BELLEWOODS | $1,300,000 | 1,227 | $1,059 | 12 Oct 2022 | Executive Condominium | 99 yrs from 12/08/2013 | 2017 |

Source: HDB

Granted – it’s not a lot and these are historical prices, but it is possible – you’ll need to camp on specific condos to keep a lookout for 4-bedders.

For yourself and your husband, your eligible loan quantum for an EC is $942,576. If you were to purchase one of these units at $1.36 million, there will be a shortfall of $66,756 that you’ll need to top up in cash/CPF. Also, if you took any CPF housing grants for the purchase of your current HDB, a resale levy of $40,000 will be payable in cash.

You mentioned that your plan is to stay long-term until your children are older, which we assume is when they’re old enough to move out. Seeing that you were only a family of two in 2017, your children are likely under five years old. Let’s say they were to move out at 30, that would be 25 years later.

We understand the pains of the moving process but since you and your husband are still in your early 30s, we think it might be a more practical approach to take advantage of your age and perhaps move once or twice instead of staying in the same place for the long term.

What’s the rationale behind this?

With an affordability of $1.36 million, your choices for a four-bedder are currently rather limited. For example, if we were to look at the options available on the market, the youngest development, Symphony Suites, is currently nine years old (the 99-year lease started in 2014), and in 25 years it will be 34.

Here’s a look at actual transactions for four-bedroom units that are 1,200 sq ft and above, but $1.3 million and below. Note that these are also for condos that are 10 years or younger.

| Project | Price | Size | $PSF | Date | Type | Tenure | Built Year |

| SEA ESTA | $1,217,000 | 1,206 | $1,009 | July 26, 2022 | Condominium | 99 yrs from 09/01/2012 | 2015 |

| TWIN FOUNTAINS | $1,250,000 | 1,206 | $1,037 | July 25, 2022 | Executive Condominium | 99 yrs from 19/12/2012 | 2016 |

| BELLEWOODS | $1,300,000 | 1,227 | $1,059 | Oct 12, 2022 | Executive Condominium | 99 yrs from 12/08/2013 | 2017 |

As a general rule of thumb, prices of 99-year leasehold developments start to stagnate after it hits 21 years of age (but of course, this is also dependant on other factors such as demand and supply of the area, characteristics of the estate, future integrations, just to name a few).

From the graph above, we can see that the price movement of 99-year leasehold non-landed private properties aged between 21 – 30 years old is lagging behind the rest of the 99-year leasehold non-landed private properties. As prices gradually recovered after the three rounds of cooling measures implemented in 2013, prices of these developments aged 21 – 30 remained stagnant and only picked up when the pandemic hit.

As such when looking at the trend, we would advise against holding onto a leasehold property for the long term.

One option you can consider is to buy a private property to stay in until your children finish primary school which is probably 7 – 11 years down the road. Of course, provided you purchase a project that is currently under 10 years old, the property will still be relatively young then so you should still have a healthy pool of buyers.

This follows too that by that time if your income has gone up, you’d have more choices to choose from. Also, since your children will be older, you may not need a helper anymore and can possibly purchase a three bedder in your preferred location. This is, of course, the ideal situation.

From the calculations above, if you were to purchase a $1.36 million property at 4 per cent interest, the monthly repayment will be $4,819. Including your $900 car loan, your monthly debt will amount to $5,719 which is 38 per cent of your combined income.

With 2 kids and a helper, depending on your lifestyle, this may/may not be a substantial amount. On top of that, you’ll be putting in all the cash proceeds from the sale of your HDB. We presume you have some reserve funds in case of emergencies but if not, it may not be the wisest decision to pump all the cash into the next property.

“Last year, in the most aggressive policy tightening since the early 1980s, the Fed lifted its benchmark policy rate from near zero in March to the current range of 4.25 per cent to 4.5 per cent, and Fed officials last month projected it will breach the 5 per cent mark in 2023, a level not seen since 2007.” – Straits Times, 3rd Jan 2023

Seeing as HDB prices are at an all-time high, it is no doubt a good time to cash out on the property while it’s profitable. However, as much as interest rate hikes may be slowing down, it seems unlikely that they will come down soon.

With the rising mortgage rates, increased construction costs, and low inventory on the market, Ms. Christine Sun, Senior Vice President of research and analytics at OrangeTee and Tie, and Mr. Lee Sze Teck, Senior Director of research at Huttons Asia both mentioned in this article that they expect private property prices to grow by five to eight per cent in 2023.

Buying a $1.36 million property today at 4 per cent interest:

| Description | Amount |

| Purchase price | $1,360,000 |

| CPF + Cash | $350,668 |

| Loan | $1,009,332 |

| Monthly repayment based on 4per cent interest and 30-year tenure | $4,819 |

Buying the same property a year later at 3.5 per cent interest but prices have gone up by 5 per cent:

| Description | Amount |

| Purchase price | $1,428,000 |

| CPF + Cash | $350,668 |

| Loan | $1,077,332 |

| Monthly repayment based on 3.5 per cent interest and 30-year tenure | $4,838 |

If you look at the difference in monthly repayments, you’ll find that a 0.5 per cent drop in interest rates on a property that costs 5 per cent more still has a higher loan repayment than one with a higher interest rate but at a lower property price.

The difference in monthly repayment based on a loan of $1,009,332 with a 30-year tenure for a $1.36 million property:

| Interest rate | Monthly repayment |

| 4.5per cent interest | $5,114 |

| 4per cent interest | $4,819 |

| 3.5per cent interest | $4,532 |

| 3per cent interest | $4,255 |

| 2.5per cent interest | $3,988 |

Moreover, you have to consider that loan rates are usually renewed every two- three years, so it’s not as if you would be locked into a high-interest rate forever. Waiting out this high-interest rate environment could be risky as that could see you get priced out over time.

But still, adopting a wait-and-see approach does give you time to build your wealth and also benefit from the increase in HDB prices, and this leads us to our next important question:

So what if you don’t intend to upgrade now? Perhaps you think that sitting on your HDB could help you earn more and subsequently have more options to upgrade later on.

Given the lower supply of newly MOP units coming onto the market over the next couple of years, it seems likely that prices of older HDBs would hold up over the next few years until the new supply of BTO starts to take effect.

As such, you might be thinking that holding on to your HDB while building a stronger cash base to provide greater options in the future could be one pathway to take.

Nevertheless, while prices have risen considerably for HDBs, it is still public housing, so the HDB market will always be regulated by the Government in order to keep prices in check. (HDB market will be kept at today’s “affordability” rate).

As housing affordability has recently come into the limelight, we’re inclined to believe the Government is likely to implement policies moving forward to ensure its affordability remains intact.

But prices are never absolute – when it comes to upgrading, the crucial question to ask is this:

If so, what does this pattern look like, and what does this mean for an HDB upgrader?

Here’s a look at the average 4-room HDB prices and private properties sized 1,200 – 1,500 sq ft (our best estimate of four-bedroom units).

| Year | Private (1,200 – 1,500 sq ft) | 4 Room HDB | Upgrader Ratio |

| 2010 | $960,000 | $372,567 | 2.58 |

| 2011 | $1,065,000 | $422,735 | 2.52 |

| 2012 | $1,122,942 | $456,295 | 2.46 |

| 2013 | $1,102,400 | $479,261 | 2.30 |

| 2014 | $1,155,056 | $444,921 | 2.60 |

| 2015 | $1,100,000 | $433,627 | 2.54 |

| 2016 | $1,066,500 | $434,479 | 2.45 |

| 2017 | $1,190,000 | $437,120 | 2.72 |

| 2018 | $1,270,000 | $431,753 | 2.94 |

| 2019 | $1,320,000 | $429,749 | 3.07 |

| 2020 | $1,335,000 | $448,608 | 2.98 |

| 2021 | $1,459,000 | $505,095 | 2.89 |

| 2022 | $1,570,000 | $549,045 | 2.86 |

Source: URA, HDB.

We’ve restricted prices of private properties to those in the Outside Central Region (OCR) region and only included private non-landed homes. The goal is to see the disparity in prices over the years, assuming HDB dwellers staying in a 4-room flat are looking to upgrade to a four-bedroom condo.

To better illustrate this, here’s what the prices look like:

And here’s what the disparity looks like over 12 years:

From the graph above, we can see that the price disparity between a 4-room HDB and a four-bedroom condominium ebbs and flows over time, but nonetheless, every peak and trough is higher than the previous.

This trend shows that should this continue, it will be harder for a 4-room HDB owner to make the jump to a four-bedroom condo over time.

As such, we think that the pros of buying a private residential home for the long term and having that certainty today outweigh the cons of waiting – perhaps even at the expense of the high-interest rate environment.

This means that if you’re holding long term e.g. 20 years then the prices today shouldn’t be such a big factor.

And of course, we always advise buyers to be prudent in their purchases. If you urgently need the additional room and are able to find something that meets your requirements, and the monthly repayment is still palatable for you (taking into consideration it may still go north), by all means, go ahead.

With HDB prices at their peak and your current HDB being profitable, it may make sense to take advantage of this situation to sell and cash out. But given the high-interest rates, and if your living situation is still bearable, you might want to take a wait-and-see approach.

However, as shown above, much of the interest savings may be wiped out by the increase in property prices during this wait. Moreover, we’ve illustrated the perils of waiting given the increasing difficulty in upgrading over the past 12 years – and it doesn’t look to get much better. We could be wrong, but our best guide is through historical data.

[[nid:603415]]

So since this property is for your own stay purposes, it should most importantly meet your living needs. As we have mentioned earlier, it’s best to exercise prudence, especially at a time like this. Should you find a property within your affordability that suits your family and the monthly repayment does not disrupt your lifestyle, then we think upgrading is a suitable option now.

The question is really just what type of property is suitable for you?

Looking at the available options on the market, they are mostly 99-year leasehold developments above 10 years of age and we would advise against holding onto this property for the long term due to lease decay concerns.

It may be a better approach to consider staying in a young leasehold property for the short to mid-term and then move again to another development with better potential before eventually right-sizing to an HDB when your children move out.

This article was first published in Stackedhomes.