Can I afford to sell my HDB flat and upgrade to a condo?

Thinking of upgrading from your HDB flat to a condo?

Wondering if it is possible?

Actually, it’s not as hard as you think…

I’m talking about the math part tho.

(Aside: the money part is highly subjective.)

You just need to figure out what are the estimated sale proceeds from selling your HDB flat .

And then do a little math to find out if you can afford the condo .

Don’t know where to start?

That’s why I’m here for you, bruv.

FYI: I’m aware that there is the possibility of keeping your HDB flat AND buying a condo, but that’s another article for another time…

Sales price of HDB flat – Outstanding mortgage loan – Mortgage loan prepayment penalty – Legal fees – Property agent commission

Estimated sale proceeds – CPF monies used (which you need to return to your CPF)

Estimated cash proceeds = 5 per cent of Downpayment

CPF monies available = 20 per cent of Downpayment + Buyer’s stamp duty + Legal fees + Property agent commission

To find out what are the estimated sales proceeds, you’ll need the following:

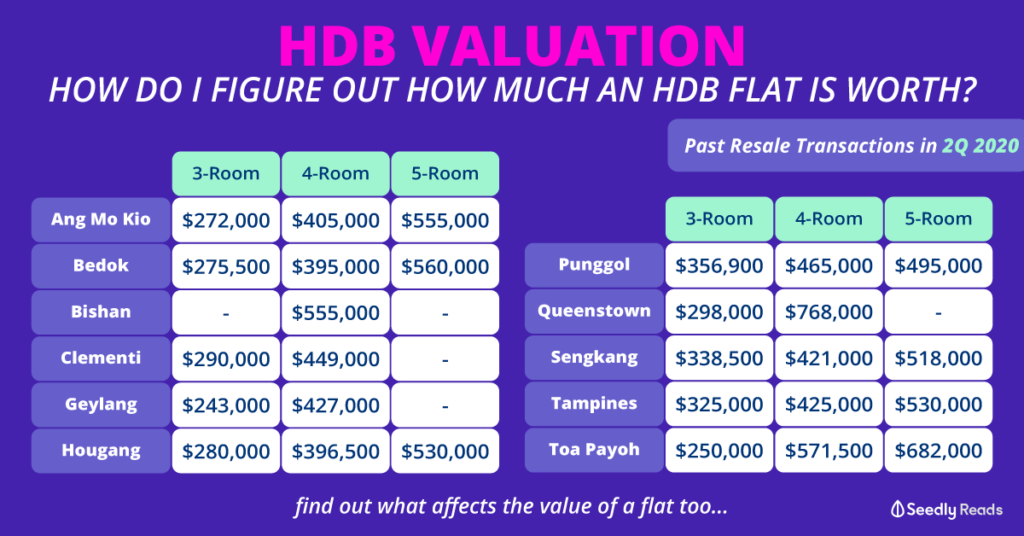

To figure out the estimated sales price of your HDB , you can reference the HDB resale median prices.

This way, you can get a sense of what the prices of past resale transactions are like for similar units in your town area or flat.

If you took a bank loan, just give your bank a call to find out what is your outstanding mortgage loan.

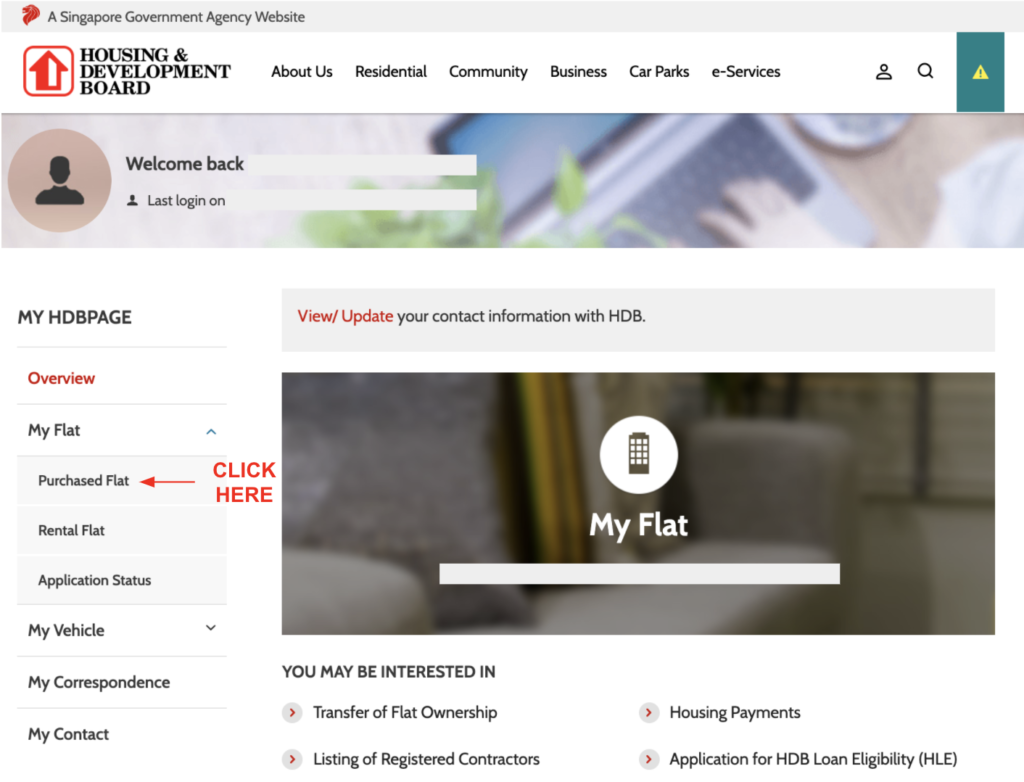

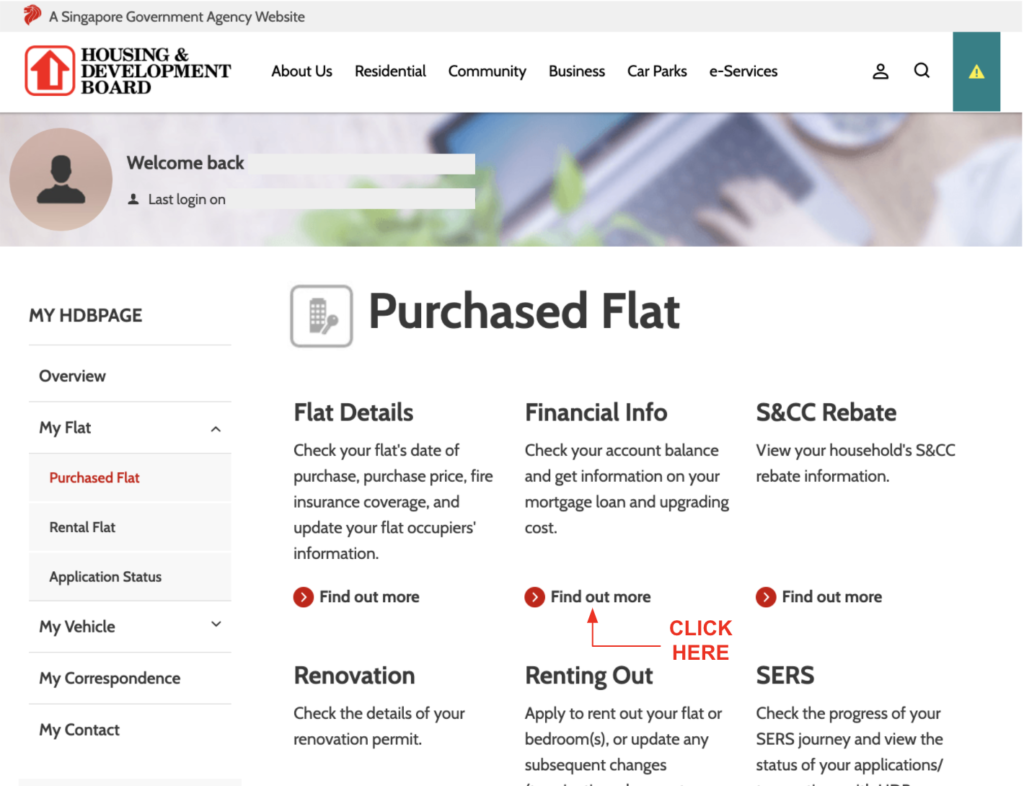

If you took an HDB housing loan, you can check your outstanding mortgage loan by logging in to My HDBPage using your SingPass.

You’ll see your outstanding mortgage loan under “Outstanding Balance”.

If you took a bank loan, you’ll probably need to pay a prepayment penalty of about 1.5 per cent of the amount which you borrowed.

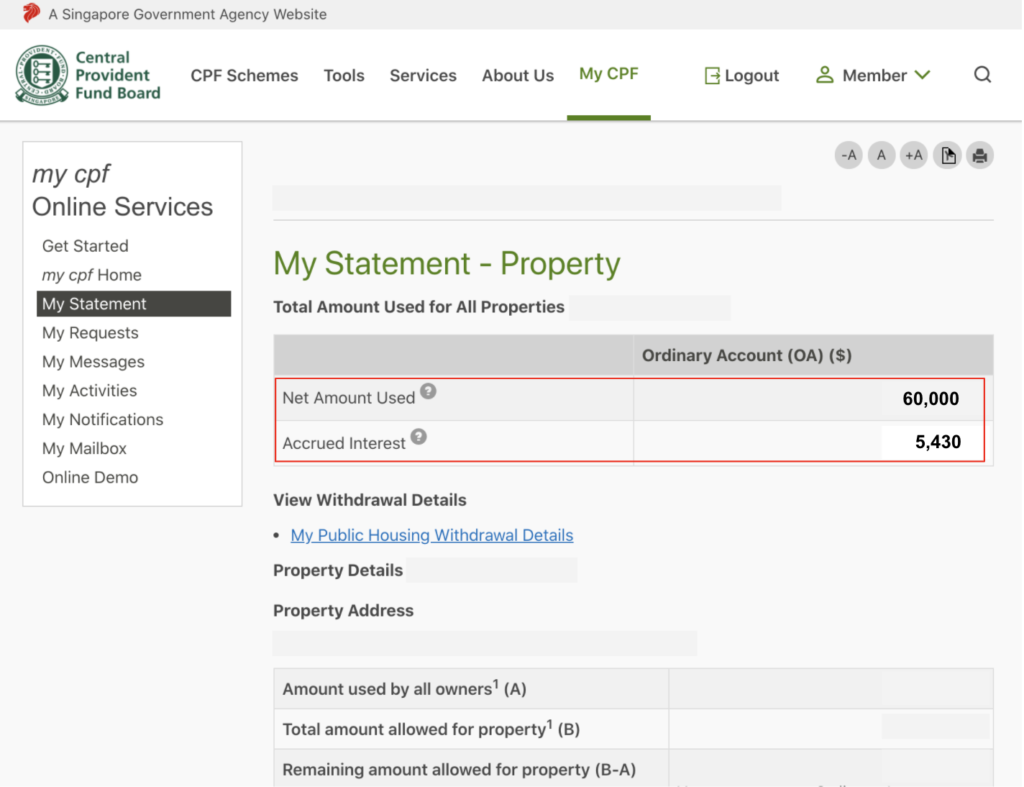

Any CPF monies used for the purchase of your flat, either as downpayment or for monthly installments.

Will have to be returned with accrued interest to your CPF account when you sell your flat.

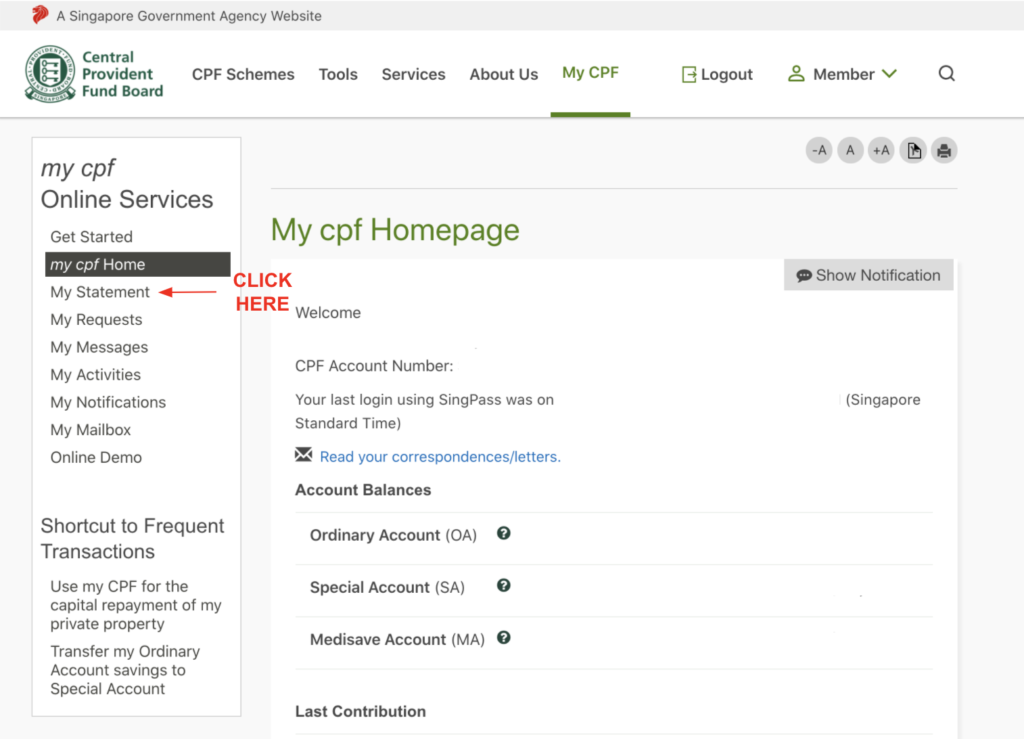

You can log in to the CPF website to find out how much you have to return.

If you engage HDB’s solicitor to act for you in the sale, you can get an estimate of the cost using their Legal Fees Enquiry service.

| Type of Legal Fee | Purpose | Amount |

|---|---|---|

| Conveyancing fee | For transfer | Based on selling price and subject to min fee of $20 First $30k: 6.75 cents per $100 or part thereof Next $30k: 5.40 cents per $100 or part thereof Remainder: 4.50 cents per $100 or part thereof |

| For total discharge of mortgage | 1-Room flat: $22 2-Room flat: $33 3-Room flat: $44 4-Room flat: $55 5-Room flat: $66 Executive flat or maisonette: $77 |

|

| Registration and microfilming | For title search fee | $10.40 |

| For total discharge of mortgage | $38.30 | |

| Miscellaneous fees | To HDB | $5.00 |

Depending on how much you sell your flat for as well as your flat type.

You can expect to pay about $500 (this is only a guess-timate) in legal fees.

If you used a property agent to sell your HDB flat.

You’ll usually need to pay between 1 to 2 per cent of the sales price including prevailing GST.

Note: it is possible to sell and buy a flat without a property agent

Once you’ve gathered all of the abovementioned information.

Here’s how to calculate the estimated sales proceeds:

Estimated sale proceeds = Sales price of HDB flat – Outstanding mortgage loan – Mortgage loan prepayment penalty – Legal fees – Property agent commission

If you’re doing the math for your HDB flat right now, you’re probably thinking:

But wait… there’s more.

If you used any CPF monies to fund the purchase of your HDB flat, you’ll need to return that to your CPF Ordinary Account.

So… to find out how much money you can actually pocket from the sale of your HDB flat, you’ll need to find out what your Estimated Cash Proceeds are like:

Estimated cash proceeds = Estimated sale proceeds – CPF monies used (which you need to return to your CPF)

FYI: alternatively, you can also use HDB’s Sale Proceeds Calculator to do the math for you.

Here’s a simple illustration to show you what I mean.

Zoe and Boon Keng (both are younger than 55 years old) currently own a 4-Room HDB flat and they wish to upgrade to a condo.

They bought their flat 10 years ago (so they’ve fulfilled their MOP).

And have been using their CPF to pay for everything — including downpayment and monthly installments.

To keep their costs low, they also decided to sell their flat without the help of a property agent.

Estimated sale proceeds |

Amount |

|---|---|

| Sale price of HDB flat | $500,000 |

| Outstanding HDB loan | $250,000 |

| Mortgage loan prepayment penalty | $0 |

| Legal fees | $290 |

| Property agent commission (1per cent) | $0 |

| CPF utilised plus accrued interest | $300,000 |

| Estimated Cash Proceeds | $50,290 |

Their estimated sale proceeds: $349,710.

But because they used their CPF, they need to return $300,000 (accrued interest included).

So their estimated cash proceeds: $50,290.

Makes you wonder if you should be using cash or CPF to pay for your home huh?

Let’s see if this is enough for them to afford a condo…

To find out if you can afford a condo, you’ll need the following:

This part is pretty straightforward.

Minimum cash downpayment is 5 per cent, only if…

Minimum cash downpayment is 10 per cent, only if…

Minimum cash downpayment is 25 per cent.

The first 5 per cent is paid (fully in cash only) when you book your unit (aka exercise your option to purchase).

The other 20 per cent is paid within eight weeks from exercising your option to purchase.

And can be funded using your a mix of CPF and cash.

The Buyer’s Stamp Duty (BSD) applies to all property purchases in Singapore.

And is calculated based on the purchase price of the property or the market value of the property (whichever is higher).

| Purchase Price or Market Value of the Property | BSD Rates for Residential Properties | BSD Rates for Non-Residential Properties |

|---|---|---|

| First $180,000 | 1 per cent | 1 per cent |

| Next $180,000 | 2 per cent | 2 per cent |

| Next $640,000 | 3 per cent | 3 per cent |

| Remaining Amount | 4 per cent |

You can use IRAS’s Stamp Duty Calculator to figure this out.

If you’re a Singapore Citizen with no other residential properties, then you can ignore this.

But if you do own other residential properties, then you’re looking at a 12 per cent ABSD rate.

| Profile of Buyer | ABSD Rates on/ after 6 Jul 2018 |

|---|---|

| Singapore Citizens (SC) buying first residential property | Not applicable |

| SC buying second residential property | 12 per cent |

| SC buying third and subsequent residential property | 15 per cent |

| Singapore Permanent Residents (SPR) buying first residential property | 5 per cent |

| SPR buying second and subsequent residential property | 15 per cent |

| Foreigners (FR) buying any residential property | 20 per cent |

| Entities buying any residential property | 25 per cent [Plus Additional 5 per cent for Housing Developers (Non Remittable)] |

Unlike HDB flats, when it comes to private property… the legal fees jump up to between $2,000 to $4,000.

This is highly dependent on the lawyer you hire and what kind of deal you get.

When buying a private property like a condo, there aren’t any fixed rules (read: industry mandated laws) when it comes to property agent commission.

The usual rate when engaging an agent to buy a property is usually 1 per cent of the property purchase price.

Some buyer’s agents might split the commission with the seller’s agent or even collect it from the seller.

So it really depends.

Basically, you’ll want to see how much cash and CPF do you need upfront .

Here’s how to calculate if you can afford the condo:

Cash and CPF needed upfront = Downpayment + Buyer’s stamp duty + Legal fees + Property agent commission

Now, let’s look at Zoe and Boon Keng’s situation again.

The couple wants to buy a condo that is worth $1,000,000.

So here’s how much they need upfront:

Cash and CPF needed upfront for condo |

Amount | Source |

|---|---|---|

| Downpayment (5 per cent to exercise option to purchase) |

$50,000 | Cash |

| Downpayment (20 per cent eight weeks after exercise option to purchase) |

$200,000 | Cash or CPF |

| Legal fees | $2,000 | |

| Property agent commission (1 per cent) | $10,000 |

Even though they need to pay the first 5 per cent in cash ($50,000).

Their estimated cash proceeds from selling their 4-Room HDB flat ($50,290) more than covers this.

The remaining $212,000 can technically be paid for using their CPF monies.

And since they returned almost $300,000 to their CPF-OA.

It means that they can technically afford the $1,000,000 condo.

If you have dreams of living in a condo.

Then this simple exercise should help you figure out how much you can get from selling your HDB flat.

And whether you can manage the initial downpayment for the condo.

HOWEVER.

My calculations do not take into account the monthly mortgage that you will be servicing for the rest of your life.

Taking Zoe and Boon Keng’s $1,000,000 condo as an example.

You’d be looking at servicing a mortgage of $750,000.

Unless you can derive some form of rental income from this new condo which you’re buying.

You’re going to be in a situation where you’re asset rich but cash poor.

Which may or may not agree with your financial goals.

So before you sell your HDB flat and buy that condo.

Think further than just the initial downpayment that you have to make…

This article was first published in Seedly.